Global East-Global West

Protecting America: Is Donald Trump A Nehemiah?

McLean, Virginia–Nehemiah’s life was an example of leadership and organization. He gave up a comfortable and affluent position in Persia in order to return to the fractured homeland of his ancestors and unite the people to reconstruct Jerusalem’s wall.

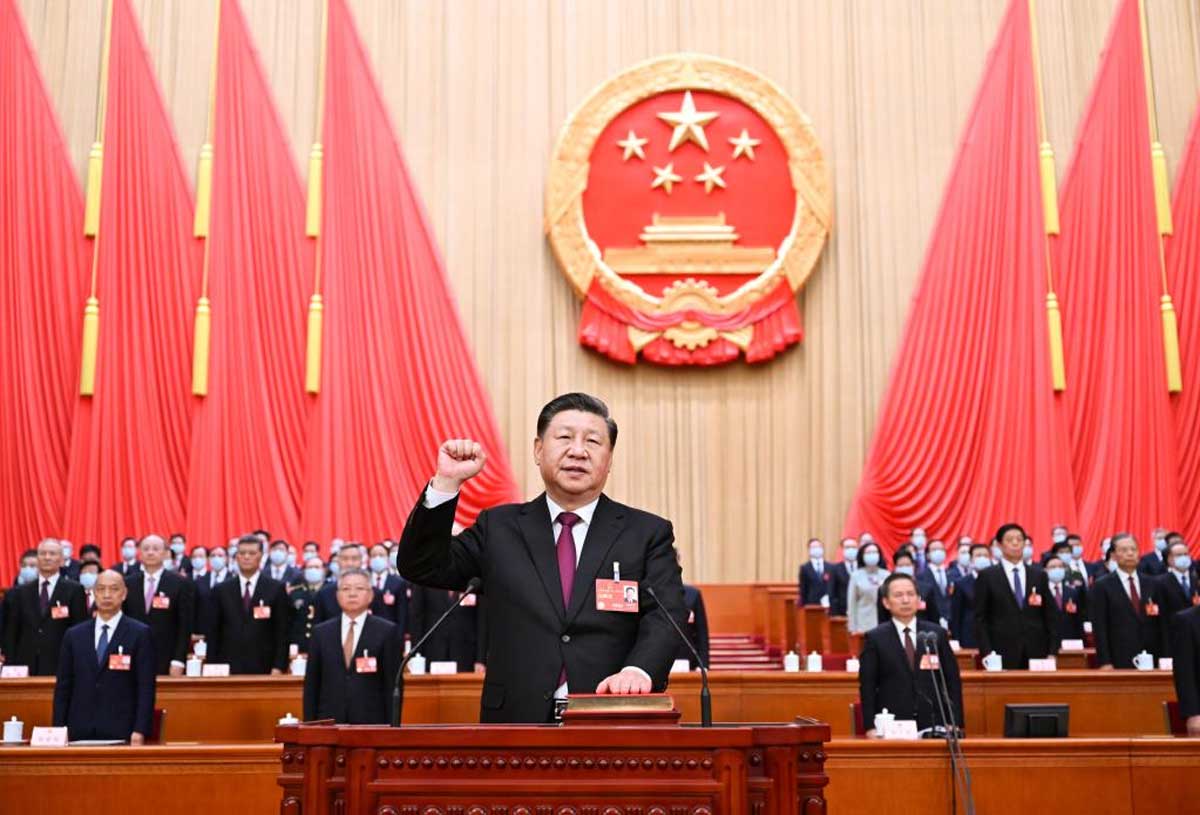

Rouhani and Khamenei are Both Winners in Iran’s Elections

Washington D.C–Iran’s recent parliamentary and Assembly of Experts elections are being heralded as major wins for Iran’s long-struggling “moderates.” Moreover, it appears that President Hassan Rouhani

Shadi Hamid on Islamic Exceptionalism

Dr. Hamid is the author, most recently, of Islamic Exceptionalism: How the Struggle Over Islam is Reshaping the World (St. Martin’s Press). His previous book Temptations of Power: Islamists and Illiberal Democracy in a New Middle East

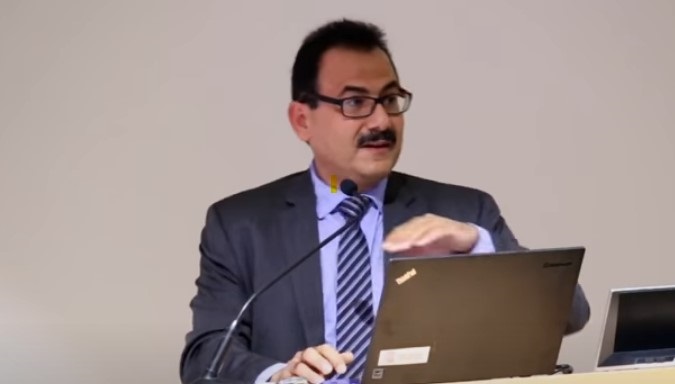

Tarek Saadawi on Internet Infrastructure Security

Dr. Tarek Saadawi is the Director of the Center for Information Networking and Telecommunications (CINT) and a professor at the City College of New York (CCNY).

The Iranian Women in American Journalism (IWAJ): Nazila Fathi

Nazila Fathi is a Shorenstein Fellow at the Harvard Kennedy School of Government. Before her current role at Harvard, she was a Tehran correspondent for The New York Times

The Iranian Women in American Journalism (IWAJ): Neda Semnani

Her name is Neda Semnani. She writes for Roll Call‘s Heard on the Hill (HOH), one of the venerable and decades-old institutions in Washington. With 1300 followers on Twitter

The Iranian Women in American Journalism (IWAJ): Setareh Derakshesh

The ongoing rivalry between Iran and the United States has always gone beyond the sphere of geopolitics to include the control of Iran’s airwaves and influence the Iranian public opinion. Voice of America/Persian News Network (VOA/PNN) has been at the

center of U.S.

The Iranian Women in American Journalism (IWAJ): Tala Dowlatshahi

Tala Dowlatshahi is the Senior Advisor for Reporters sans Frontières (Reporters without Borders). A member of the Overseas Press Club

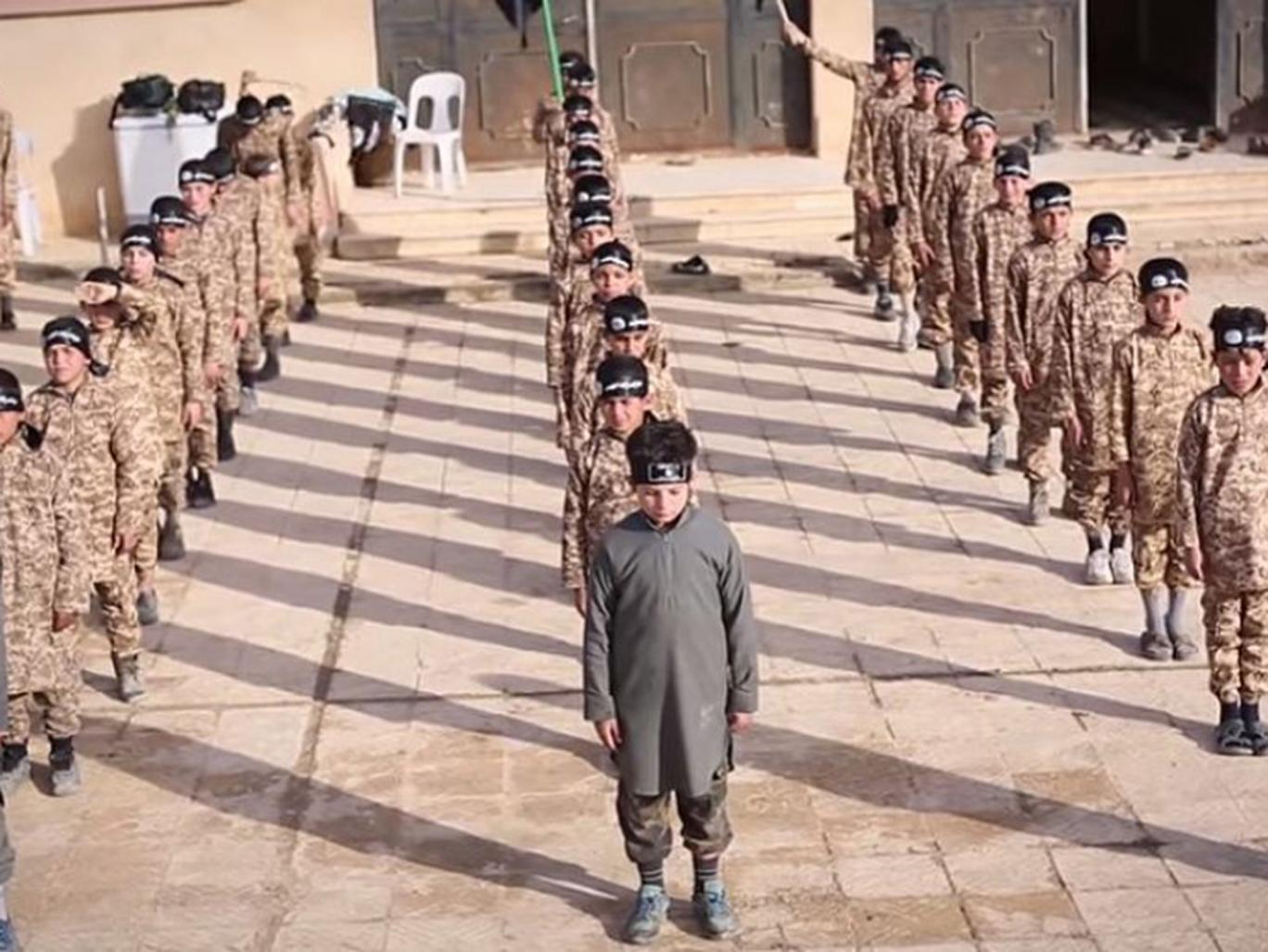

The Next Generation of Mujahideen

New York City–After the Soviet invasion of Afghanistan in 1979, voices began to rise up within the Islamic world, calling for young men to travel to Afghanistan to defend their Muslim brothers and sisters.